Adobe (NASDAQ: ADBE)

It’s rare that a business is both a FinTwit and Compounder Bro darling. Adobe managed to achieve this distinction during and after COVID due to its industry standard products, subscription-based pricing, high returns on capital, and prodigious cash flow generation. Yet its stock price has slid roughly 20% this year and about 40% since July 2024. It fell so far that it popped up on my radar. If you follow John Huber over at Saber Capital Management you’ll recall his writeup and tweets about large, well-known businesses that experience stock price fluctuations of 50% during a 12-month period. Remembering his insights and knowing that Adobe has had one of the all-time great runs in history, its stock price is up more than 1,600x since going public in 1986, I decided to investigate and see what was going on.

There is so much coverage on Adobe that I don’t think I can offer any value regarding its product offering or business model. I assume most of you have used it before in some capacity. The focus of this writeup will be CEO compensation, my own qualitative research on the business, and its valuation.

CEO Compensation

Reading Adobe’s 2025 Executive Compensation section was arduous. A full 42 pages of single-spaced small text. Yuck.

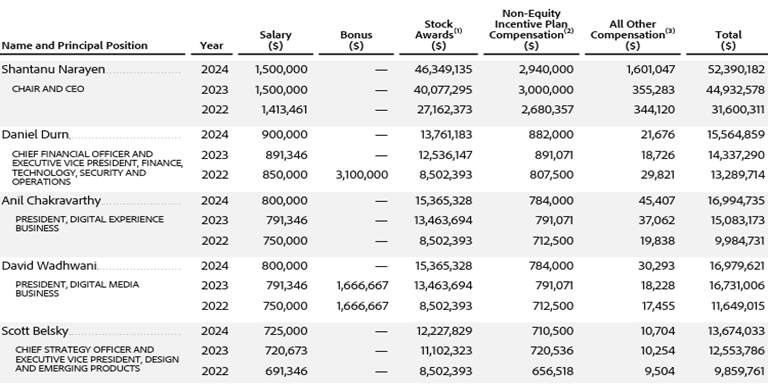

The main elements of CEO Shantanu Narayen’s compensation were his base salary, cash incentives, and equity incentives.

Note: All the information in this section was taken from the 2025 Proxy Statement unless otherwise noted.

Base Salary

Mr. Narayen’s base salary in 2024 was a cool $1,500,000.

Cash Incentives

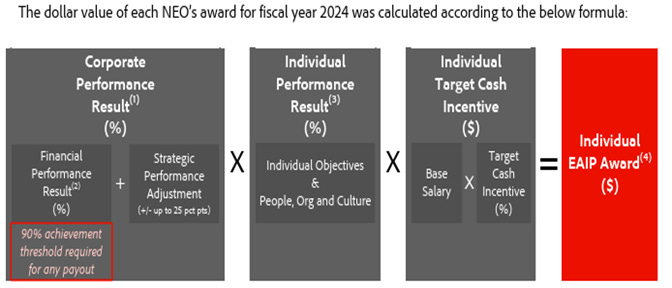

These awards were paid out in cash as a percentage of the CEO’s base salary. It was comprised of three parts multiplied together: a Corporate Performance Result, an Individual Performance Result, and an Individual Target Cash Incentive.

A screencap of this formula is shown in the screencap below and was taken from p. 46.

The Corporate Performance Result was further subdivided into a Financial Performance Result and a Strategic Performance Result. The Financial Performance segment was based on achieving at least 90% of revenue targets and a non-GAAP diluted EPS, “set relative to the midpoint of the Initial Public Guidance.” Before you ask the answer is, “Yes, of course the Compensation Committee has changed the financial performance metrics over the years for one reason or another.”

The Strategic Performance Result was based on the Compensation Committee’s discretion to increase or decrease the Corporate Performance Result by 25% based on the achievement of “corporate priorities” and objectives for the performance period. It goes on to list a bunch of results which may or may not be considered as part of strategic performance such as asset-write downs, M&A, “unusual items”, etc.

The Individual Performance Result metrics were about the vaguest I’ve ever seen from a tech company. I’m not kidding when I tell you the three metrics were:

To drive growth and innovation strategy.

Focus on products, platforms, and ecosystem.

Invest in customers and partnerships.

These metrics seem like table stakes for a CEO of any business, much less one valued over $100 billion. I wondered too how they could be measured and tested to prove the CEO actually performed well in these areas.

Individual Target Cash Incentive

This was set by the Compensation Committee and based on peer group data. The CEO’s target opportunity was 200% of his base salary.

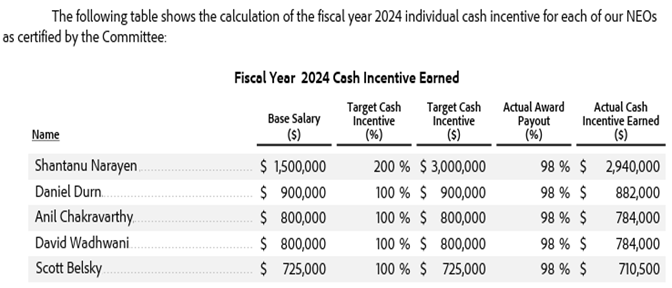

The screencap below, taken from p. 54, shows the Cash Awards received by the CEO and other NEOs at the business.

Equity Incentives

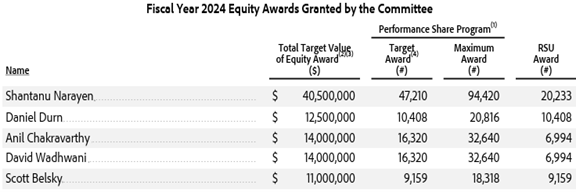

The CEO’s equity incentives were comprised of a 70/30 split between Performance Share Awards and Time Based RSUs.

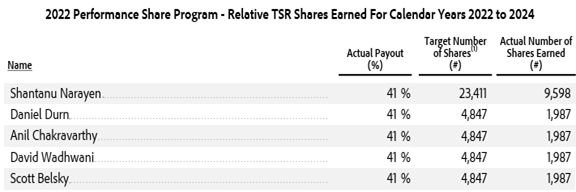

The Performance Share Awards in 2024 were based 50/50 on a Relative TSR Goal over a three-year performance period and a Net New Sales Goal which is measured and determined annually, but shares don’t vest until after the full three-year performance period. I wish the time frame was longer, maybe five years or more, but overall this didn’t sound too bad. Per p. 49, “Each performance goal is weighted 50% and achievement of each goal is determined independent of the other. Participants can earn between 0% and 200% of the total target number of performance shares granted to them under the 2024 PSP.”

The Relative TSR Goal was based on the TSR of Adobe’s stock during a three-year performance period. For example, the three-year performance starting in 2025 would go through 2027. Its TSR performance will be compared to what are called “Index Companies”. There was no information in the 2025 Proxy Statement, so I asked Google’s Gemini for some help, and it directed me to the 2024 Proxy Statement where “Index Companies” were mentioned. On p. 46 of that document, they were described as “the Nasdaq 100 Index as of January 1, 2023, excluding the second class of stock for any company with dual-classes of stock (the “Index Companies”).” Were those same companies still included in the definition of “Index Companies” in 2024 and 2025? Who knows? I didn’t find anything in 2025 Proxy Statement indicating whether there were changes to the definition.

The screencap below, taken from p. 50, displays the Relative TSR Goal performance criteria.

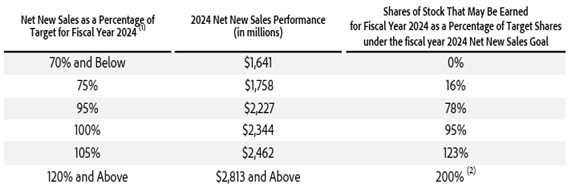

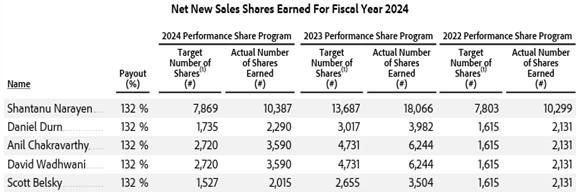

Per p. 50 again, the Net New Sales Goal was based on “(1) net new ARR in Digital Media and (2) subscription revenue growth in Digital Experience. Starting with fiscal year 2025, the Net New Sales Goal is based on (1) ending ARR growth in Digital Media and (2) subscription revenue growth in Digital Experience. The update from net new ARR to ending ARR growth in Digital Media aligns with the Company’s new guidance approach starting fiscal year 2025 of guiding to annual ending ARR growth instead of quarterly net new ARR in Digital Media.”

Also taken from the same page, “To earn any shares based on the fiscal year 2024 Net New Sales Goal, the Company must surpass 70% of the Initial Public Guidance in order to achieve any payout. Adjustments will automatically be made to the calculation of the achievement of the Net New Sales Goal to exclude the effect of material mergers and acquisitions and foreign currency fluctuations, whether the impact is positive or negative, that occur during an applicable fiscal year.” A screencap of its Net New Sales targets are shown in the screencap below and were taken from p. 51.

There was very little information provided about the Time-Based RSUs other than a blurb on p. 51 which states, “Recognizing that a substantial portion of our NEOs’ compensation is performance-based, the Committee grants time-based RSUs to our NEOs in order to satisfy our retention objectives and promote continuity in our business. The RSUs granted in fiscal year 2024 vest quarterly over four years. Accordingly, our RSU program provides our NEOs with strong incentives to remain employed by Adobe, while providing additional rewards for growth in our stock price with less dilution to the Company than time-based stock options, which were not granted by Adobe to any NEO in fiscal year 2024.”

The three screencaps below show the FY 2024 Equity Awards Granted by the Compensation Committee, the 2022 – 2024 TSR Goal Shares Earned, and the 2022 – 2024 Net New Sales Shares Earned. They were taken from pp. 54, 56, and 57.

One feather in Adobe’s cap is that the CEO is required to own a minimum of 20x his base salary throughout the year. Given how much the CEO makes, which is a ton as you’ll see in the next slide, I wish the threshold was higher, but what can ya do?

Adobe’s most recent Executive Compensation table is displayed below and was taken from p. 66.

There is a reference that I didn’t screencap that stated the amounts reflected in the table weren’t the actual economic value realized by the CEO and other listed officers. While that may be true, you can rest easy knowing that they’ve all made a ton of money over the last several years even if the results in the table aren’t 100% accurate.

Qualitative Research

I used three avenues for my qualitative research. They were feedback via scuttlebutt, YouTube videos, and a couple of AI ChatBots.

It was remarkable how similar the answers were from each source. I divided them into two buckets: What People Don’t Like Adobe and What People Do Like About Adobe. I also touch upon where Adobe seems to be losing and winning customers.

What People Don’t Like About Adobe

The most common feedback I received, especially from people I talked to and YouTubers, was that a lot of their current and former users just don’t really like it anymore. The one’s who still use the software do it begrudgingly or because they have to. There was a big hoopla in 2024 about an update to the “Terms and Conditions” of Adobe’s software. The language in the update gave the company almost free reign to access their user’s data. The concern was that Adobe was going to use customer data to train its generative AI models. Users had to agree to the update, or they could not access their account. This caused a sudden backlash, and Adobe updated the language to not allow such access. I asked someone if it was accurate to describe this update as essentially paying Adobe to steal their work and they said, “Yes.” The business lost trust with a solid chunk of its user base after this fiasco.

Another constant complaint was that they feel like Adobe does not and has not listened to customer feedback for years. Tied to this is the feeling that their software updates don’t really move the needle in terms of adding value. Minor features are added here and there, but leave a lot to be desired.

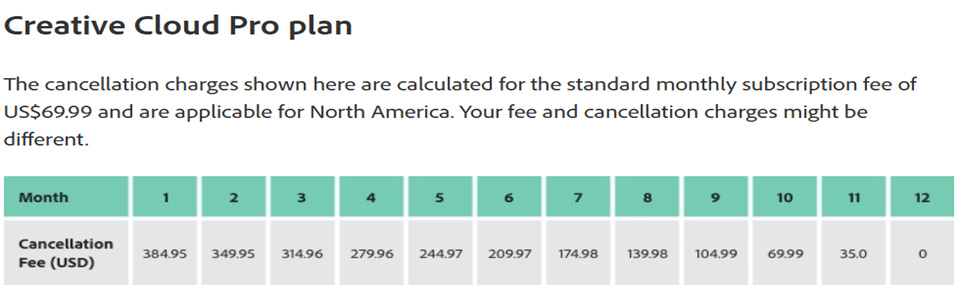

Both the subscription model and its price point were another sore spot. Adobe, much like Microsoft Windows, used to be purchased one time and the user would receive updates until a completely new version of the software was released a couple of years later. Current and former users highlighted that the updates provided by Adobe are minor at best and do almost nothing to change the value of the software. Related to that is its price point. Adobe’s Creative Cloud Pro subscription which includes everything from Photoshop to Illustrator, Premier Pro, and Firefly comes in at $69.99 per month. That works out to just under $840 per year. That’s more money than users paid for the one-time purchase of Adobe’s suite before it changed over to its current subscription model. The most striking complaint I fielded regarding its price was from a professional artist who stated, “They’re like drug dealers. They offer you one app for $20 a month or you can get multiples of the product even if you won’t use it for $70 a month.” There is no way for users to bundle only a few apps together for a reasonable price.

The final complaint I’ll mention is Adobe’s cancellation policy. There is a dedicated page to it which you may find here. The current policy states that users are allowed 14 days after purchase to cancel and receive a full refund. If they cancel after the 14th day, then they are charged 50% of the remaining value of their contract as a cancellation fee. A screencap showing an example of a user canceling the Creative Cloud subscription by month is displayed below.

Users may still access their Creative Cloud files on their computer and the Creative Cloud website, subject to a 2GB cloud storage limit. If the user has exceeded the 2GB limit then they have 30 days to move their files out of the cloud. Since users don’t own Adobe software anymore, once the subscription is cancelled, they cannot use it anymore. This differs from some of its competitors that allow users to buy software once and either have a perpetual license for updates or the ability to use the current version of their software and pay for updates as time goes on.

Keep reading with a 7-day free trial

Subscribe to Possible Value Research to keep reading this post and get 7 days of free access to the full post archives.