Computer Modelling Group (TSX: CMG and OTCPK: CMDXF) Part 1

Computer Modelling Group (TSX: CMG and OTCPK: CMDXF), referred to as “CMG” for the remainder of this writeup, is a high return on capital software business servicing the oil and gas industry. FY 2025 revenues increased by 19% to CA$ 129.45 million from CA$ 108.68 million in FY 2024. FY 2025 net income decreased (~15%) to CA$ 22.44 million from CA$ 26.26 million in FY 2024. CMG is headquartered in the mean streets of Calgary, Alberta, Canada.

History

CMG started as a research project by Professor Khalid Aziz at the University of Calgary in 1978. Quoting Mr. Aziz at the 27 second mark of this video, “So the proposal was to set up an institute to initiate research for these complex processes for the recovery of oil especially from tar sands and heavy oil reservoirs. So that was the objective.”

As you may have guessed, the initial focus was on heavy oil, but CMG has since expanded its technology and software offering to conventional oil, enhanced oil recovery, integrated production system modelling, entry transition, and data analytics products.

Fun fact per CMG’s Wikipedia page: The business was a non-profit for the first 19 years of its existence.

The business went public in 1997 on the TSX where it continues to be listed. It also trades Over the Counter here in the US under the ticker CMDXF.

Per its homesite, CMG’s customers include 100% of the Super Majors, 18 of the world’s top 25 largest oil companies, 9 of the top 10 National Oil Companies, and 70% of the top unconventional oil companies. Besides its headquarters in Calgary, CMG boasts offices in Bengaluru, Bogota, Dubai, Houston, Kuala Lumpur, Rio de Janeiro, Oslo, and Oxford.

CEO

Pramod Jain is the CEO of Computer Modelling Group and has acted in this capacity since 2022. Mr. Jain has a Bachelor of Technology, Electrical and Electronics Engineering Degree from Kurukshetra University in India, a diploma in Corporate Finance from INSEAD in France, and a master’s degree in industrial engineering from Mississippi State. Go Dawgs and Hail State.

CEO Compensation

Reading CMG’s most recent Management Information Circular, the Canadian equivalent of a Proxy Statement, was dare I say, enjoyable. I jumped to the Compensation section immediately and what did I see on p. 21? Well, I’ll let you read it. “The TMGN (Talent Management, Governance, and Nominations) Committee believes the attainment of these goals will provide a rewarding and challenging environment for executive management and employees and allow them to focus, along with other business metrics, on total revenue, profitability, and return on invested capital which in turn will provide attractive returns to Shareholders.” This is exactly what I want to read regarding compensation and incentives.

The CEO’s compensation in FY 2025 was comprised of a base salary, an Annual Incentive Plan, and Equity Awards. After these main pieces of his yearly compensation are discussed, I will also mention the performance stock options he received when he joined CMG.

Base Salary

Mr. Jain’s base salary for FY 2025 was CA$ 520,000.

Annual Incentive Plan

Information on the Annual Incentive Plan was provided on pp. 25 – 27 of the Information Circular. There were two elements of the plan: 40% of the total bonus was based on the Corporate Bonus Matrix while the remaining 60% was based on the CMG Bonus Matrix.

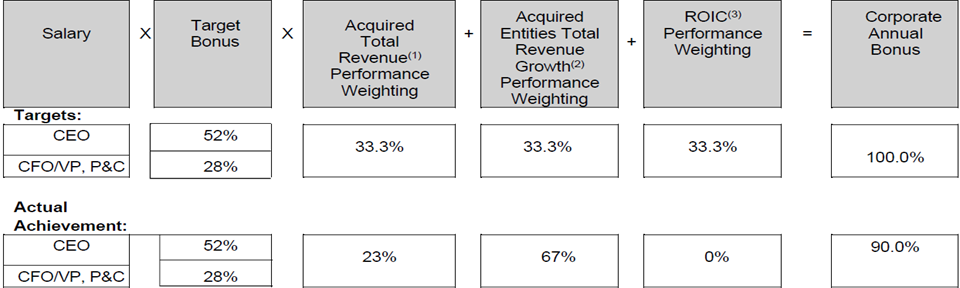

The Corporate Bonus Matrix was explained on p. 25 where it states, “The bonuses payable are calculated based on meeting a combination of targets for Acquired Total Revenue, Acquired Entities Total Revenue Growth, and ROIC. These three criteria represent key measures in assessing the Corporation’s performance related to acquisitions and effectiveness of capital deployed. The potential bonus payable was capped at 200% of target.”

The screencap below, taken from p. 26 of the Circular, provides the Corporate Bonus Matrix formula, hurdle rates, and actual results achieved by the CEO.

You’ll notice that the CEO achieved 0% for the ROIC Performance Rating which I found odd, but there was a paragraph below the screencap explaining why this happened. It was transparent in a way that I’ve rarely seen, so I thought it deserved further mention. It reads, “In fiscal 2024, ROIC performance was positively impacted by a tax deduction related to acquired intellectual property. In the current fiscal year, the ROIC performance metric did not meet the threshold required for payout under the variable compensation program, resulting in a 0% achievement level. The Corporation anticipates that there may be near-term underperformance against ROIC targets due to the current concentration of its portfolio and the early stage of its acquisition strategy. Until a more diversified base of acquired businesses is established and these entities have been fully integrated and matured under the Corporation’s ownership, ROIC is not expected to reflect the long-term value creation potential of the strategy. The Compensation Committee believes this context is critical in evaluating current performance outcomes and remains confident in the long-term alignment of the ROIC metric with shareholder value creation.”

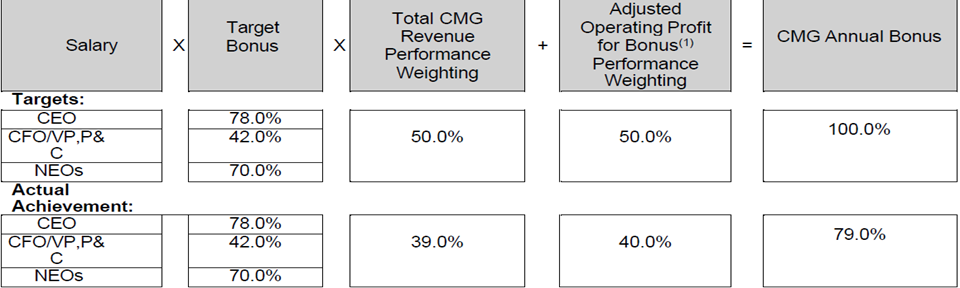

Per p. 26 of the Circular, the CMG Bonus Matrix was “… calculated based on an equally weighted combination of Total Revenue Growth and Growth in Adjusted Operating Profit for Bonus targets. Targets for CMG, without acquired entities, were set at year-over year growth of 10% for each performance metric.”

The screencap below, taken from p. 27 of the Circular, provides the CMG Bonus Matrix formula, hurdle rates, and actual results achieved by the CEO.

Mr. Jain earned a total of CA$ 563,784 from the Annual Incentive Plan. Per p. 30 of the Circular, 60% of that amount was paid in cash while the remaining 40% of the after-tax bonus was used to purchase common shares of Computer Modelling Group.