DocuSign (NASDAQ: DOCU)

DocuSign (NASDAQ: DOCU) is a SaaS business whose goal is to make business easier by digitizing agreements. Per p. 6 of the Fiscal Year 2022 (FY 2022) 10-K, “Every agreement has an agreement process: how it is prepared, signed, acted on, and managed. Traditional agreement processes are slow, expensive and error-prone because they involve many manual steps, disconnected systems, and paper signing. Our value proposition is simple to understand: eliminate the paper, automate processes, and connect to other systems where work gets done. This allows organizations to reduce turnaround times and costs, largely eliminate errors, and deliver a streamlined customer experience.” Per p. 6 of the FY 2022 10-K again, DocuSign has over 1.1 million customers, more than 1 billion users in 180 countries and offers its customers over 400 integrations with businesses like Salesforce, Zoom, Microsoft, Workday, Apple and Oracle. The business is headquartered in the mean streets of San Francisco, California and generated $2.107 billion in revenues and $445 million in Free Cash Flow (FCF) in FY 2022. That’s an eyepopping FCF yield of 21%. I’ll talk about the FCF Yield in the Valuation section of this writeup.

History

DocuSign was founded in 2003 by Court Lorenzini, Tom Gonser and Eric Ranft. In a video with Mr. Gonser on DocuSign’s website which is linked here, he says that the business was started to “fundamentally change the way that business transactions happen. A lot of businesses transactions need signatures, forms to be filled out etc., and back when we started the company the software companies that were in place to make this happen were very complicated.” He and his team met with potential customers to see what they wanted in terms of an e-signature solution. Their answers were that the product must be easy to use, legally binding and secure. DocuSign’s original product was their e-signature solution which continues to be their flagship product to this day. The business has since offered Contract Lifecycle Management (CLM), Insight/Analyzer and Notary products. DocuSign acquired SpringCM in 2018 for $220 million in cash, Seal Software in 2020 for $188 million in cash and LiveOak Technologies in 2020 for $38 million in stock which power their CLM, Insight/Analyzer and Notary products respectively. DocuSign was a tech unicorn before going public. Per crunchbase, the business raised $536.2 million in funding over 20 rounds putting its valuation well in to the billions of dollars.

CEO

Dan Springer is the CEO of DocuSign. He was born in Brooklyn, New York but grew up in Seattle, Washington. He graduated with a double major in mathematics and economics from Occidental College while captaining both the soccer and lacrosse team. Per his interview with Jason Nazar, the CEO of Comparably, he worked in “forecasting” for a while after undergrad and went on to earn an MBA from the Harvard Business School. Per the DocuSign Investor Relations website, prior to his current role he was a consultant for McKinsey and Company, CMO at NextCard, CEO of Telleo, Managing Director at Modem Media and CEO of Responsys where he eventually led the sale of the business to Oracle for $1.6 billion in 2013. After the sale of Responsys he took time off to be a stay-at-home dad while his children were in high school. I think this is admirable and not something you see from someone who is both driven and highly successful in the business world.

CEO Compensation

Mr. Springer’s remuneration is made up of a base salary, semi-annual cash incentive and long-term equity awards which are composed of restricted stock units (RSUs) and performance-based restricted stock units (PSUs). Variable compensation, which includes cash incentives, RSUs and PSUs, make up 98% of his total compensation. DocuSign uses Compensia as their compensation consultant.

Base Salary – Per p. 33 of the 2022 Proxy Statement, “Our base salary approach allows us to attract and retain our NEOs with predictable, fixed annual cash compensation. The Committee sets base salaries for our NEOs after considering the scope, responsibility and skills required of each NEO’s position, the competitive market (based on an analysis of compensation peer group and compensation survey data), past performance, and internal pay parity.” Mr. Springer’s FY 2022 base salary was $350,000.

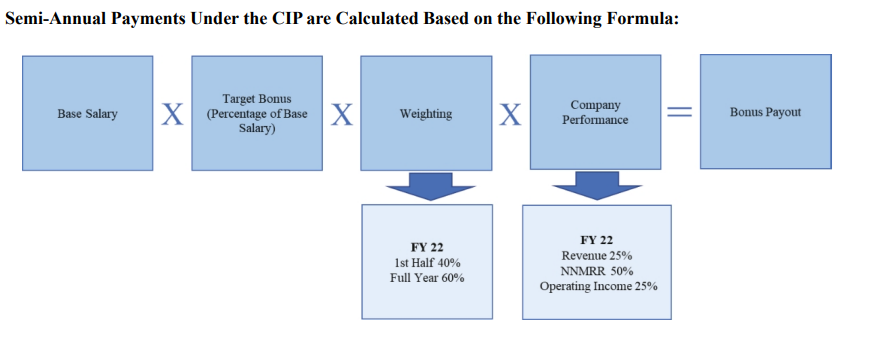

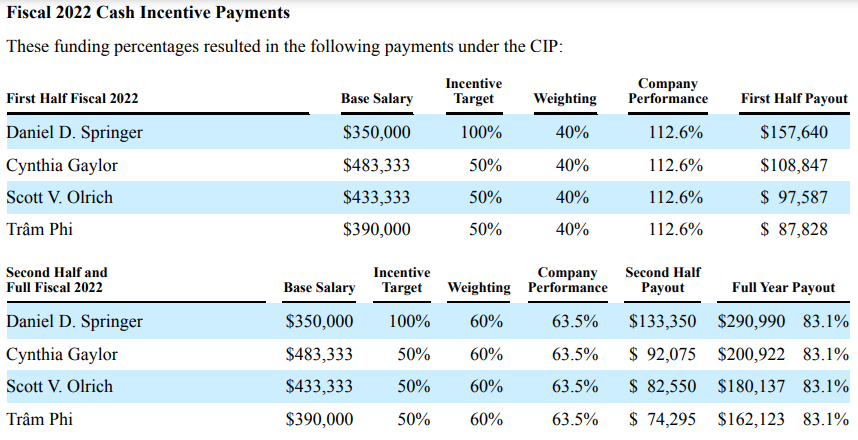

Cash Incentives – Per the chart on p. 33 of the 2022 Proxy Statement, the metrics used to gauge Mr. Springer’s cash incentive awards are increases in revenue, net-new-monthly-recurring-revenue (NNMRR) and adjusted operating income. The screencaps below show the formula used to award Cash Incentives and the definitions of the performance metrics listed above. I think including revenue and NNMRR is okay, but I was a bit suspicious of the third metric. Unsurprisingly, adjusted operating income excludes stock-based compensation expenses, acquisition expenses and “other special items” without describing what they are in detail. If you’ve read any of my writeups in the past, then you’ll know that I’m immediately suspicious when a business excludes stock-based compensation from their “adjusted earnings” or adds it back in their cash flow statements as a non-cash expense. This is a red flag 🚩.

The screencaps below show the weightings of each performance metric over the first and second half of the fiscal year, overall company performance versus the performance metrics and the overall Cash Incentive payouts to each named executive officer.

On p. 37 of the 2022 Proxy Statement, it states the business will add an ESG modifier to its Cash Incentives in 2023. Knowing what I know about management compensation, I’m going to bet the ESG metrics will be relatively easy to achieve and will result in more compensation for DocuSign’s named executive officers. Also stated on the same page, “With this change we aim to further motivate our executive leadership to meet high standards in advancing our values and our ESG priorities as a company, in addition to delivering strong operational and financial results.” Whatever that means.

Long-term equity incentives – As stated above, these are made up of RSUs and PSUs. Half of Mr. Springer’s long-term equity incentives are awarded as RSUs with the other half being PSUs. Per p. 37 of the 2022 Proxy Statement, RSUs “generally vest over a four-year period subject to the recipients employment with us.” Per p. 92 of the FY 2022 10-K, “The majority of RSUs granted after January 31, 2018 vest upon the satisfaction of a service-based vesting condition. From time to time, we may also grant RSUs that are subject to either a performance-based or market-based vesting condition. The performance-based conditions will be satisfied upon satisfaction of certain financial performance targets. The market-based conditions will be satisfied if certain milestones based on our common stock price or relative total shareholder return are met.” The metrics for the “performance-based vesting condition” or “market-based vesting condition” for RSUs aren’t described in further detail which, in my opinion, gives the Compensation Committee plenty of leeway in awarding them. This is another red flag 🚩. Per the same page, PSUs “which generally are earned based on the achievement of one or more pre-established business or financial performance metrics, as described below, and subject to the recipient’s continued employment with us through the performance period.” Pp. 38-39 provide some color regarding PSU awards. Per p. 38 of the 2022 Proxy Statement, “During fiscal 2022, consistent with PSU awards granted in fiscal 2021 and fiscal 2020, the Committee granted PSU awards based on our total stockholder return (“TSR”) relative to the Nasdaq Composite Total Return Index (the “Index”) measured over a three-year performance period. The Committee granted these awards to align our NEOs’ incentives with the long-term interests of our stockholders.” The screencap below take from p. 39 of the 2022 Proxy Statement shows the possible vesting scenarios for Mr. Springer’s PSUs.

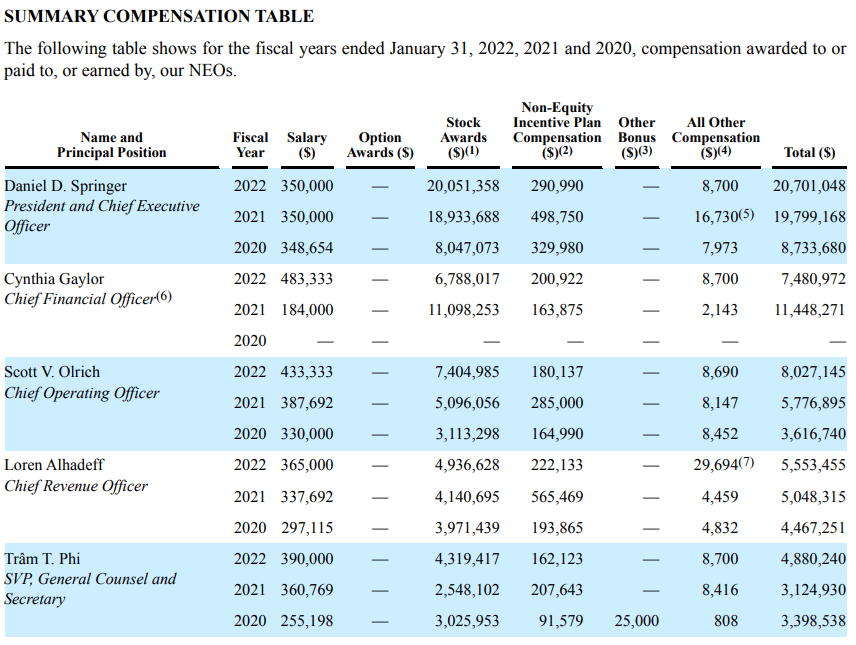

The screencap of the Summary Compensation Table from p. 42 of the 2022 Proxy Statement shows the total compensation for Mr. Springer and other Named Executive Officers of DocuSign over the last three fiscal years.

To close out this section, I think it’s fair to say that DocuSign awards generous amounts of stock awards to their Named Executive Officers. I like, but don’t love that they tie PSUs to their stock price. I wish they would tie it to growth in free cash flow or returns on invested capital, but using stock price as a long term metric is okay in my book because that’s what matters ultimately. My only hope is that the Compensation Committee sticks to the TSR metric and doesn’t decide to modify it next year. I say this because DocuSign’s stock has been crushed and I mean crushed over the twelve months. It’s down over 60% since last May and down over 75% since its peak price of $310.05 a share in early September of 2021. I’ll have to keep my eye on this when the business reports it’s 2023 Proxy Statement. An additional negative feature regarding the stock is the lack of insider ownership. Directors and Named Executive Officers collectively own 2.55% of the business. I’d like to see more insider ownership and this is unfortunately another red flag 🚩.

What isn’t a red flag is subscribing to my Substack. It helps out tremendously.

Back to our regularly scheduled programming.

What Does DocuSign Do?

As stated above, DocuSign seeks to make business easier by digitizing the agreement. They reinforce this in nearly all their public communication and advertising. I think they’re largely right in doing so because agreements are a business necessity. Every business transaction relies on an initial agreement to set the parameters of what is and isn’t included, but the process of completing them up until recently was antiquated. Also stated above, DocuSign’s most recognizable product is their e-signature solution. Nearly everyone in a “professional service” or work-from-home job knows about this product. DocuSign is by far the leader in this space and the product is so powerful that it has become a verb. You don’t electronically sign something, you DocuSign it.

Not as many people know about DocuSign’s other products which, including the e-signature solution, fall under what is now called the DocuSign Agreement Cloud. There are four segments to the DocuSign Agreement Cloud: Prepare, Sign, Act and Manage. A screencap of their Agreement Cloud is shown below. It is taken from slide 9 of their Spring 2022 Investor Presentation.

The Prepare segment allows users to generate and negotiate agreements and use guided forms to create/manage new ones. The most powerful feature of this segment is the Analyzer product. Per p. 9 of the FY 2022 10-K, the business states that their Analyzer product “helps customers understand what they’re signing before they sign it.” Yeah, great, but what does this mean though? Luckily, DocuSign made a nice 2:30 video on it which is linked here. God love ‘em. Per the video, Analyzer uses artificial intelligence to conduct a risk analysis of the agreement and displays the results on scorecards. The risk analysis is based on the customers own legal and business standards. It takes in to account the inclusion and absence of clauses of interest. Clauses of interests or risky terms can be easily edited and inserted back into the agreement document. Gen & Negotiate integrate with Salesforce to generate agreements and allow DocuSign’s customers to merge data in to the agreement with just a few clicks. Per p. 9 of the FY 2022 10-K Guided Forms “enables complex forms to be filled via an interactive, step-by-step process. It adapts subsequent steps based on inputs from previous steps, thereby streamlining the user experience and minimizing errors.”

A portion of the Sign segment has been introduced already via the e-signature solution. This segment also offers the Identify and Notary products. Identify is a product that digitally verifies the recipient by having them scan their driver license, passport or European eID. Once verified, their identity is tied to the agreement as are the authentication details. The Notary product allows customers to digitally notarize documents via live video conferencing and real time digital signing. More in depth videos about how the Identify and Notary products work are linked here and here.

The Act segment includes the Contract Life Management (CLM) and Payment products. Per the FY 2022 10-K again, CLM “automates workflows across the entire agreement process. It provides larger organizations the flexibility to model complex processes for generating, negotiating, acting on, and storing agreements.” Per the video linked here about their Salesforce CLM, this product allows their customers to create reusable and standardized templates for agreements with all relevant information being included in the document. DocuSign’s CLM workflow can also automatically route the agreement to internal approvers and customers in the right order. Also, the agreement can be edited in Microsoft Word and the new version can be saved and uploaded without having to send emails back and forth to update it. This product is so good that it is included in Gartner’s Magic Quadrant for CLM’s. The Payment product is simple to understand. It allows the user to request both a signature and payment for an agreement. The payment request is simply added to the signature request which prompts you to add your payment method, information, etc. The Payment product integrates with debit/credit cards, ACH payments, Apple Pay, Google Pay, and PayPal.

The Manage segment includes the Insight and Monitor products. Insight, like Analyzer, is quite powerful. Per the FY 2022 10-K again, Insight uses “AI to search and analyze agreements by legal concepts and clauses. It can work across a large volume of agreements, both from DocuSign eSignature and from other sources.” Per the linked video here, Insight creates a searchable index of all agreements across a customer’s enterprise. The product allows you to filter agreements, apply advanced keyword search and even has prebuilt concepts to automatically search for. You can also add your own concepts based on your firm’s contractual or legal needs. It also lets you compare clauses across multiple contracts to see how they differ. The Monitor product is more related to account safety and not necessarily the agreement itself. Per the FY 2022 10-K, Monitor “uses advanced analytics to track DocuSign eSignature web, mobile and API account activity across the customer’s organization to provide near real-time visibility and strengthen security operations.” This product is particularly useful for an audit trail.

DocuSign also has industry specific products for real estate brokers, mortgage providers, the U.S. Government (the best customer any business can have) and the Life Sciences sector which are based on their Agreement Cloud offering.

The Agreement Cloud is what sets this business apart from its competitors. DocuSign has moved on from e-signature to the entire agreement process. They do compete with other businesses across each of their four segments, but none of them currently match DocuSign’s entire offering of generating, managing, and completing agreements.

Valuation

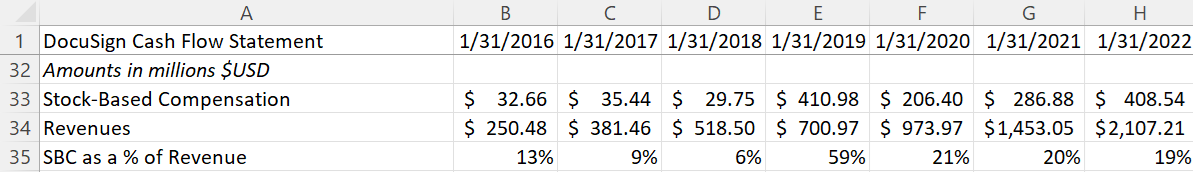

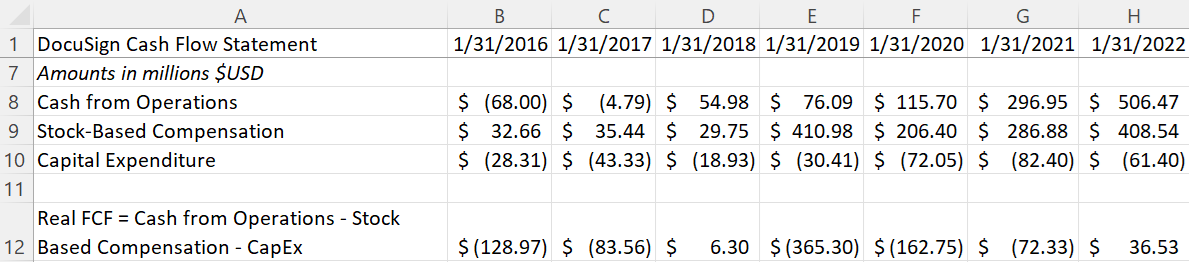

I mentioned that DocuSign has a free cash flow yield of 21% in the introduction to this write up. That is an exceptional free cash flow yield for any business regardless of industry. I haven’t seen too many growing businesses with free cash flow yields north of 10% so one with 21% piqued my interest. There is more to this metric though. DocuSign’s listed operating cash flow adds back stock-based compensation as a non-cash expense. The screencap below shows the dollar amounts of stock-based compensation issued by the business since 2016 along with the percentage of stock-based compensation to revenue.

I’m not an expert in stock-based compensation, but issuing hundreds of millions of dollars of it over the last few years while your business is doing about $2 billion a year in sales feels like a lot. Since FY 2019 (1/31/2019), DocuSign’s ratio of stock-based compensation to revenue is right at 25% and has been trending down to 20% over the last three fiscal years. I don’t know if there is a right answer for what stock-based compensation to revenues should be, but, again, 20-25% just feels like a lot. That’s not to say that DocuSign doesn’t have a long growth runway. It certainly does and I’ll discuss that more in the Outlook section. However, this amount of stock-based compensation is another red flag 🚩.

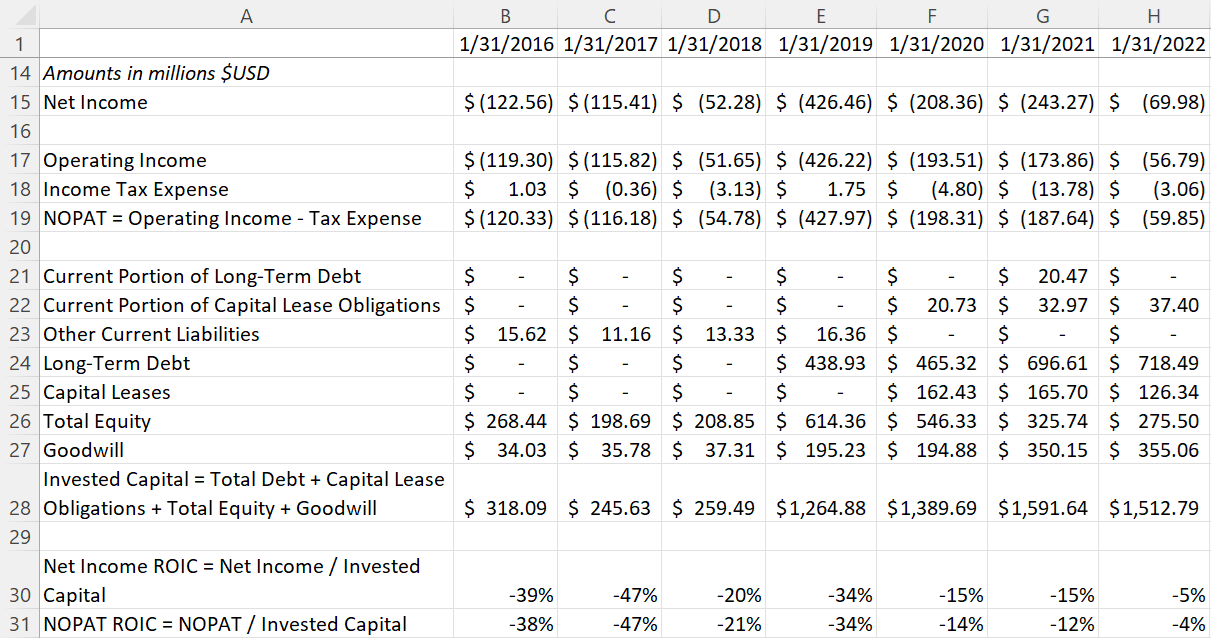

DocuSign’s free cash flow and returns on capital share a similar fate. Stock-based compensation destroys so much of both. My Real Free Cash Flow (RFCF) and Return on Invested Capital (ROIC) calculations are shown in the screencaps below.

I pulled data since 2016 from TIKR as that is as far back as it goes. Real Free Cash Flow was barely positive for FY 2022. To DocuSign’s credit, RFCF has trended upward every year since going public so that is a positive sign. With real free cash flow of $36.53 million in FY 2022, that means DocuSign currently trades at a 427x multiple given its ~$15.6 billion current valuation. For those of you wondering at home this also translates to a ~7x sales multiple based off FY 2022 revenue. Those are eye-watering valuations to say the least. Returns on invested capital have had the same trajectory as free cash flow. They’ve never been positive since going public, but they’re heading towards breakeven as each year passes by. I don’t think a return on incremental capital calculation is warranted given the negative returns on invested capital.

Outlook

There are a few concerns that I have with DocuSign as it moves forward in its journey as a public company. The first is competition. Given the little push back I’ve received when asking people about DocuSign, the biggest concern is that they don’t have a moat and barriers to entry are low. I thought about this and did some further research. Their biggest competitor by far, from what I’ve found, is Adobe Sign which is part of the Adobe Document Cloud. Adobe became a competitor following their acquisition of EchoSign in 2011. My first response to this is that yes, Adobe is absolutely a competitor that has a lot more in sales, employees, bigger brand, etc. The thing with Adobe Sign is that it’s not the main product of its parent organization. My second response is that I’m a big believer in businesses that focus on their niche which is what DocuSign does. I remember seeing a tweet or presentation about a business and their main competitor was a part of Oracle. The person representing the business said that their competitor was a line item for Oracle and not a huge revenue driver for them so there were concerns about it getting lost in the fray and corporate bureaucracy which is one of the defining features of large businesses. That always stuck with me and it’s one of the rules I use when looking at competitive dynamics. I believe that this is the case in this instance. I’ve read Adobe’s annual reports and they do not break out Adobe Sign’s revenue or market share which makes me think that neither are substantial or a threat to DocuSign. There were two interesting quotes about competition from Mr. Springer last March during an interview with Joe Kernen on CNBC’s Squawk Box . At the 6:08 mark he states, “I think in the signature business, as you said, we are the dramatic market share leader. We thought about competition in signature, we tend to think about it as paper and manual processes. That’s what we’re fundamentally competing against.” Mr. Springer follows this up with another quote about their R&D spending at the 6:38 mark stating, “We spend more in R&D than anyone else has in revenue in this space.” Referring to the FY 2021 10-K, DocuSign’s revenue was $1,381,397,000 and R&D expenses were $271,522,000 meaning that their revenue is at least 5x their nearest competitor as of a year ago. My gut tells me that Adobe Sign hasn’t closed that gap considerably since then. Also, DocuSign outscores Adobe Sign on G2 and, as mentioned in the introduction, has over 400 integrations versus Adobe Sign’s 100. All of these added together tells me that DocuSign is still comfortably ahead of its competitors.

Another pushback I’ve encountered is DocuSign’s price. Their “Standard” plan is $25 per user per month and includes e-signature along with a host of other features. I readily admit that this isn’t the cheapest product on the market. I do think it’s prudent to take a step back and look at the entire picture though. In a world where labor prices are only increasing and consumers demand anywhere, anytime products to expedite their business processes, DocuSign delivers. Imagine a scenario where you have just one agreement between two people being created, sent out and signed manually versus one where you have the Standard plan and only use the e-signature feature. You must create the agreement on your own in this scenario. There’s no time or money saved between manually doing it versus the Standard plan since you’re only using e-signature. The difference is apparent once the agreement is sent. If you send it manually you spend time printing and shipping the document. You must wait for it to be received, signed and sent back to you and hope that there are no errors in transit or on the document itself. With the Standard plan the sending and receiving of the document is completed much quicker. All the recipient needs to do is open the document once it is received via email, add their e-signature and a completed copy will be sent to all parties involved. Voila. No need to wait on the mailman or UPS/FedEx guy. So much productivity is freed up and so many time consuming, manual processes are eliminated from this one agreement. When you look at it this way, I think the $25 a month fee is a bargain.

My third and fourth concerns are about the continued issuance of stock-based compensation and increase in shares outstanding. I stated in the Valuation section that DocuSign has, in my opinion, a lot of stock-based compensation. That trend doesn’t look like it’s going to be slowing down anytime soon. Per p. 92 of the FY 2022 10-K, “As of January 31, 2022, our total unrecognized compensation cost related to RSUs was $875.8 million. We expect to recognize this expense over the remaining weighted-average period of approximately 2.2 years.” Shares outstanding have also increased at a steady clip over the last few years. They have increased at a CAGR of 4.87% from 156.79 million in FY 2018 to 198.86 million in FY 2022. The Board of Directors did authorize a $200 million stock buyback program in March of this year which is something I like to see. I’m not sure if this will move the needle though in terms of significantly reducing shares outstanding though.

A final concern is DocuSign’s debt load which by my calculations currently stands at ~$718 million. $37 million of long-term debt is comprised of 0.5% Convertible Senior Notes due in 2023. The remaining $681 million is comprised of 0% Convertible Senior Notes due in 2024. The 2024 Notes cannot be converted until after December 15, 2023. On the bright side, the business has just over $800 million in cash and short-term investments. This combined with the <1% interest rates on the debt aren’t detrimental in my opinion even though long-term debt is currently 2.6x stockholder equity.

Let’s move on to the positives for DocuSign going forward. The big one is their transition to the Agreement Cloud. Per their Spring 2022 Investor Presentation, the business believes that their Total Addressable Market (TAM) has doubled to $50 billion since it went public. E-signature alone makes up half of the TAM. Per the linked Squawk Box video above, Mr. Springer believes the business is still in the early innings of their game. At the 3:00 mark Mr. Kernen flat out asks Mr. Springer what his penetration rates are domestically and internationally. Mr. Springer’s response was, “We think its single digit penetration for that TAM in the U.S. High, high single digit in the U.S. and probably low to mid-single digit depending on which other countries you’re in around the world.” Seeing as how the business did just over $2 billion in revenue last year, I think it’s safe to say that there’s still a very long runway for growth.

I wrote earlier about the current products that are offered in the Agreement Cloud, but what about the future of it? In the video linked here, Jim Wagner, the VP of Agreement Cloud Strategy, talks about where the product offering is going. The Agreement Cloud is heading towards Smart Agreement Cloud which he mentions at the 1:24 mark of the video. He mentions that the Smart Agreement Cloud uses artificial intelligence to answer the question, “What do you want to do with your agreements today?” Do you want to simply prepare an agreement? Do you want to negotiate and connect agreements? Do you want to amend agreements, report to regulators and improve your processes? The Smart Agreement Cloud will allow you to do all of that. He also goes on to talk about the power of connected agreements. He states that at the 4:18 mark that at DocuSign, “We don’t see agreements anymore as static images. We don’t see agreements as documents that are completed and tucked away into a file drawer. We see agreements as living, breathing business assets. And we see agreements as living, breathing business information that’s connected to your ERP, that’s connected to your CRM and not just connected because it’s done so in a programmatic way, but in an intuitive way. We know that when we see payment terms, we know where that information needs to be connected. We know when we see renewal dates, we know where that information needs to be connected. We know that when we see ongoing deliverables or obligations who needs to be reminded. Those are the journeys we want to support through connected agreements and through the DocuSign agreement cloud.” The last part of the video starting at the 5:22 mark discusses how the future of the Agreement Cloud will help customers improve their processes on a daily, data-driven basis. The collection of data throughout the entire Agreement Cloud allows DocuSign to provide you with Agreement Content Data which includes contract types, extracted clauses/terms and concept analysis and search and Agreement Process Data which includes contract workflows preparer/signer behavior. This allows their customers to spot contracting trends, avoid workflow bottlenecks and manage performance. The combination of the current product offering, the use of artificial intelligence, transforming of agreements as living, breathing assets and the data-driven approach to help customers improve their agreement process is both the Smart Agreement Cloud and the future of DocuSign outside of e-signature. There’s obviously competition in this space and the risk that their future product offering won’t work out very well, but as I stated above, I’m unaware of any competitors that offer a comprehensive set of products for agreements like DocuSign which bodes well for the business.

The main point that I wanted to drive home in this section is that DocuSign comes through on their promise of making business easier by saving their customers time and money while reducing risk. Time and money are saved by expediting the agreement process. DocuSign allows their customers to sign, send/receive, arrange, store, manage, edit and complete their agreements much faster than doing it manually with paper and pen. Risk is reduced through their easy-to-use software that automates tasks which leads to the elimination of errors and creates a robust audit trail. This is a win-win for both sides. DocuSign makes money while doing business is made easier for their customers. This is a hallmark of a potentially wonderful business. There is one more thing I’d like to mention about their products. They are the future of the agreement process. More and more agreements every year will start and end digitally. We are not going back to a world where we wait on agreements to be sent back and forth through the mail, email or fax and completed manually.

Another hallmark of wonderful businesses are yearly increases in revenue and high gross margins. DocuSign has achieved both since going public. Between FY 2018 – FY 2022 DocuSign grew revenues from $518 million to $2.1 billion which a CAGR of over 32%. Guidance for FY 2023 revenues is in the range of $2.47 - $2.48 billion which is only an increase of ~12%. This projected slowdown in sales is obviously not ideal and I would expect the business to get punished for it over the next 12 months because it has been primarily valued on a sales multiple. I’m okay with this though given how great their products are and the reality that every growing business has years where sales increase at decreasing rates which may be below the expectations of Wall Street. Gross margins over the same period have fluctuated between 70% - 78%. These are both things that I want to see as a potential investor. The growth in revenues and high gross margins also helps answer the concern about DocuSign’s moat and low barriers to entry. Given the brutal nature of capitalism, why have revenues increased so much with sustained high gross margins if DocuSign doesn’t have some kind of moat or barrier to entry?

Another feather in their cap is that DocuSign is an excellent place to work. It has 4.3 stars and 86% of people would recommend working there according to Glassdoor. The business has been listed as one Glassdoor’s Top 50 Places to Work for six consecutive years. Dan Springer is also listed as one of the most highly rated CEOs on the site. I also came across a couple of encouraging quotes from Mr. Springer regarding DocuSign’s culture while doing research. Quoting him at the 25:45 mark from his interview with Jason Nazar, the CEO of Comparably, referenced above, about onboarding and hiring employees during the COVID lockdown, “We have four key goals: Product innovation, customer success, making this the best place our employees have ever worked and if we do all of those right, we’ll have good financial outcomes. I say at the end, “If you go back to work and you’re not sure how your job is aligning with at least one, hopefully a couple of those core goals, call me, shoot me an email. I will personally sit with you and figure out how your job aligns to those.” He goes on to say that less than 10% of new hires reach out to him. My only comment about this quote is that I hope those good financial outcomes start materializing sooner rather than later. During the same interview at the 28:20 mark he states, “But for me on top of this concept of the clarity of the vision (of a company), it is really taking an interest in making employees successful. If people like you are there and you are making a priority their success, it’s amazing how they want to get behind you.” It seems like part of DocuSign’s secret sauce is an engaged and appreciated workforce with a CEO to match. He seems to not only be saying the right things but doing them too. If what he was saying was lip service, then the business wouldn’t have achieved its sustained high workplace ratings over the last six years.

Conclusion

So, is DocuSign a compounder? God damnit, I wanted it to be, but I can’t grant it that status at the current time. Before I started doing research on the business, I flirted with the idea of the stock being an “any price” investment meaning that any price I potentially bought at would generate good returns over the long-term. I’m glad I didn’t follow through with that given what’s happened to the price over the last year. The decision was made infinitely easier because I’m poor and don’t have funds to invest right now. So that helped. Without considering valuation, DocuSign is more than just a verb. It is a wonderful business with great products. They’re not resting on their laurels with e-signature and have taken the risk to expand their product offering to the Agreement Cloud. They’re also in the early innings of the game according to their CEO and given their revenue growth from last year they most likely just crossed into the double-digit penetration rate in the United States. They’re way ahead of the competition, at least from what I can tell, and ultimately come through on their promise of making business easier for their customers. What holds them back is their incentive structure, the fact that the Compensation Committee doesn’t provide a defined set of metrics and hurdle rates for granting RSUs, the lack of insider ownership, liberal usage of stock-based compensation and its current valuation. That’s not to take away from the business or its many achievements. In fact, I think it has a chance of being a compounder in the future given its capital light nature, high gross margins, product offering and growth runway. I’ll just have to wait and see. I really wanted this one to work out, but unfortunately, I’m going to pass on DocuSign at this time.

Thanks again as always for reading. If you liked this writeup then please feel free to share it and subscribe!

Please reach out to me at possiblevalueresearch@gmail.com, @Possible Value on Twitter and @Heshy on MicroCapClub with any comments, concerns or questions. Lastly, don’t forget to tell someone that you love them.

*** Remember that this isn’t investing advice. Consult a trusted financial or investment advisor before making any kind of investment decision. ***

Disclosure: I do not own shares in DocuSign.